The core of our business is a thorough analysis of the credit of our future partner.

Our strategy is to invest with companies with strong growth prospects, proven business models and defendable market positionings.

Central to our investment approach is responsible investing, where we strive to deliver long-term sustained value for our investors, society, and the environment.

We invest across the credit spectrum from financially stable to distressed entities.

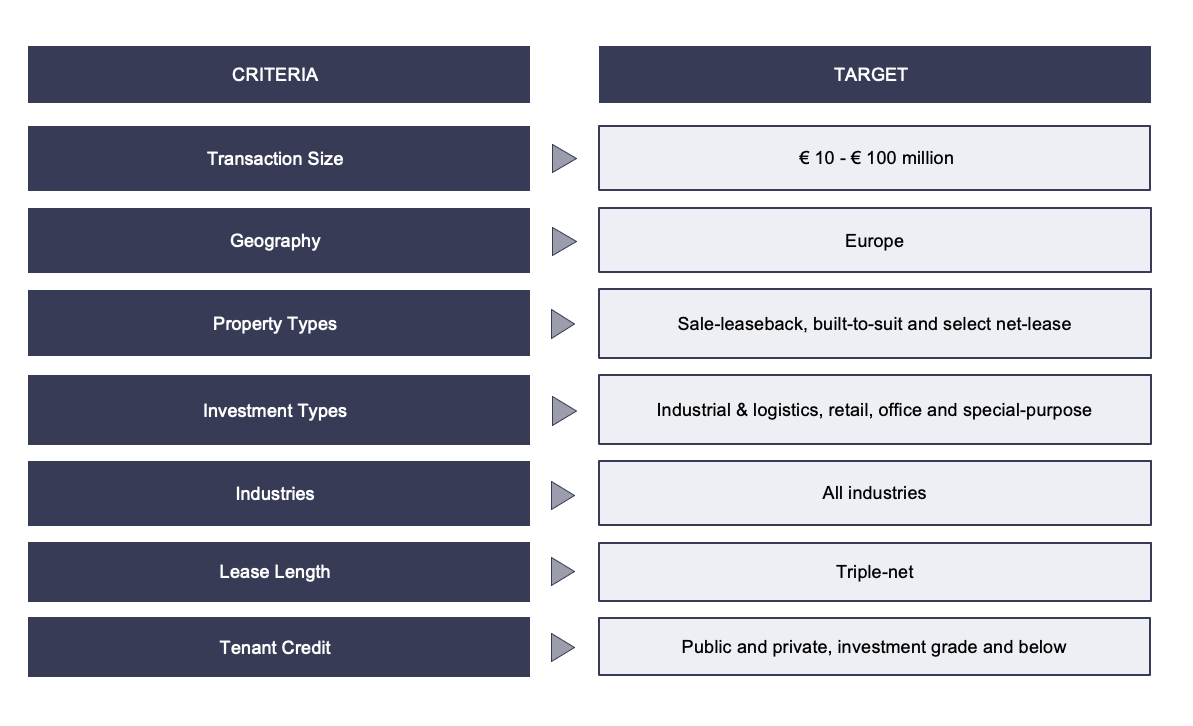

LeadCrest’s investment objective is to build a diversified portfolio of high-yielding real estate assets, occupied by credit tenants on long-term, triple net leases.Underwriting a sale-leaseback transaction is namely a credit strategy where real estate serves as additional collateral.