PAN - European Experience

Certainty of close

Bespoke Deal Structures

Future financing for

growth and expansion

LeadCrest’s knowledge and expertise extends to both major and peripheral European markets. The firm’s objective is to become the primary financing partner of European firms for all their real estate needs regardless of asset type and location.

The LeadCrest team has built a strong reputation around process and certainty of close. A significant amount of time is committed to analyzing prospective transactions prior to the issuance of an LOI, offering corporate sellers a higher certainty of close.

LeadCrest capitalizes on the depth of experience in the U.S. net lease market and seeks to replicate some of the unique structuring aspects in Europe. LeadCrest aims to innovate and implement structures which will meet the corporate objectives of European firms while taking into account their operational constraints.

LeadCrest aims to use build-to-suit financing as an attractive source of capital to finance the growth or expansion of European firms.

The core of our business is a thorough analysis of the credit of our future partner.

Our strategy is to invest with companies with strong growth prospects, proven business models and defendable market positionings.

Central to our investment approach is responsible investing, where we strive to deliver long-term sustained value for our investors, society, and the environment.

We invest across the credit spectrum from financially stable to distressed entities.

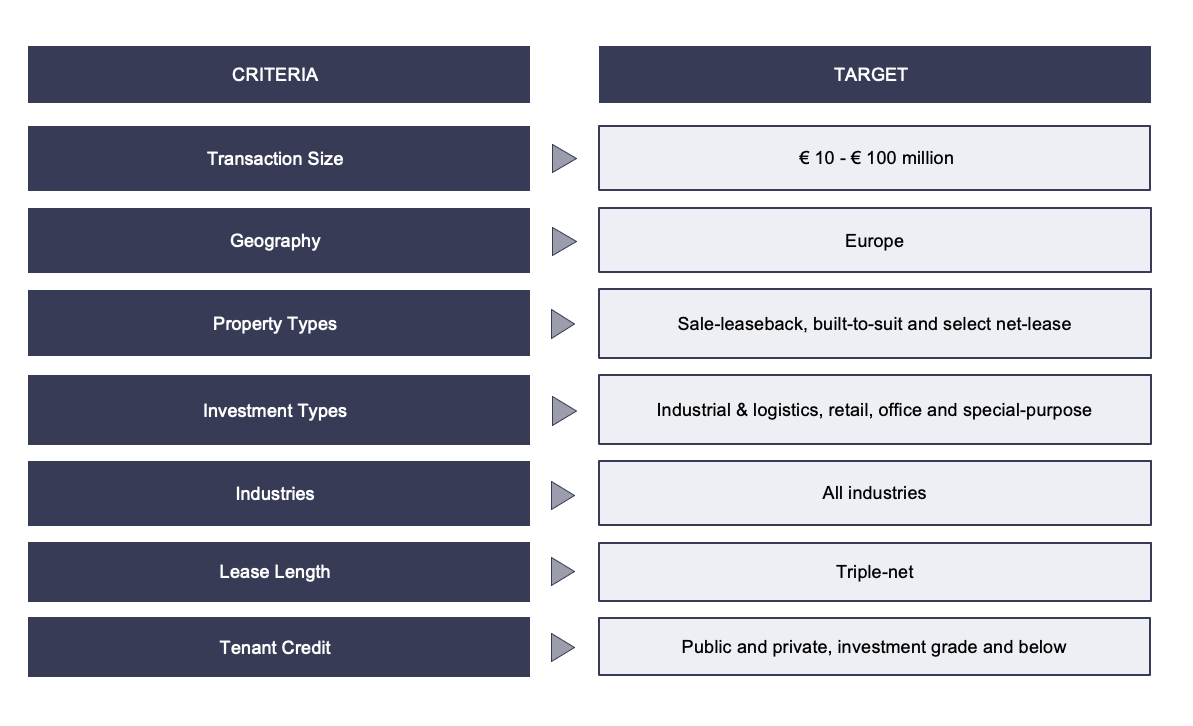

LeadCrest’s investment objective is to build a diversified portfolio of income-producing real estate assets, occupied by credit tenants on long-term, triple net leases. Underwriting a sale-leaseback transaction is namely a credit strategy where real estate serves as additional collateral.